We will discuss the process of formation of one person company in this article, including the necessary registration, compliance, and other requirements. Starting a one-person business is becoming an increasingly popular choice for entrepreneurs looking to establish a business

The advantages of a one-person company are numerous; it’s relatively easy to set up and requires minimal paperwork, and it’s an ideal way to test out a business concept before committing to a larger venture. But, it’s important to understand the legal requirements and restrictions associated with a one-person company before you take the plunge.

Formation of one Person Company:

One Person Businesses (OPCs) are companies that have only one shareholder, who is recognized as the company’s shareholder. OPCs are often formed when there is just one founder or promoter who is the company’s sole shareholder.

The concept of one person company will also be discussed during this session. Among the many benefits that OPCs provide to businessmen and entrepreneurs who are starting a business, these companies are much more popular than sole proprietorships because of the numerous benefits that OPCs provide.

As you will read in this article, we are going to be covering a step-by-step process of the formation of OPC. We will also be exploring the eligibility criteria for registering one. Important steps of formation of OPC Company are given below:

Step: 1 Applying for Digital Signature Certificate

It is necessary to provide the following documents in order to obtain the Digital Signature Certificate (DSC) of the proposed director:

- Aadhaar Card

- Address Proof

- PAN Card

- Photo

- Email Id

- Phone Number

Step: 2 Apply for a DIN number

The proposer will have to submit a SPICe Form along with a copy of the proposed Director’s name, his/her address, as well as the Digital Signature Certificate (DSC) in order to obtain a Director Identification Number (DIN) for the proposed Director. At the moment, Form DIR-3 only applies to companies that already exist; therefore, with effect from January 2018, the applicant is no longer required to submit Form DIR-3 separately from the application.

Step: 3 Applying for name approval

Taking the next step in the process of incorporation of an OPC involves applying for the approval of the company’s name. This means that ABC (OPC) Private Limited will be the name of the company.

It is necessary that you fill out the SPICe 32 application form in order to approve the name that you have selected. Form SPICe 32 is an application that allows one preferred name along with the significance that the name should be retained. Applicants can submit a new name if the original name is rejected by applying for another Form SPICe 32 application if the original name is rejected.

After the name has been approved by the MCA, we will move on to the next step of the process.

Step: 4 Required Documents

To prepare the required documents for submission to the ROC, we will need to prepare the following documents:

- The memorandums of association (MOA) are the guidelines or rules which a company should follow.

- The AoA outlines the rules of operation for a company.

- It is necessary to appoint a Nominee in order to meet the requirement that there is only one Director and one Member. The Nominee will be appointed by the person himself. During this time, the candidate will be required to submit the Nomination form (INC-3) along with a copy of their Pan Card and Aadhar Card.

- There must be proof of the company owner’s name and address, a NOC from the company’s owner, and proof of the company’s registered office address.

- Declaration in the form INC.-9 and DIR-2 of the proposed Director.

- In order to demonstrate that all the requirements have been met, professional certification is required.

Step: 5 Filing some forms with the MCA

Occasionally, there will be a need to file some forms with the MCA in order to have the MCA approve it. For this reason, you are required to attach these documents along with the Director’s DSC and the professional’s AOA, as well as the SPICe Form, SPICe-MOA, and SPICe-AOA, and all of this information is to be uploaded to the MCA website in order to be approved.

The PAN Number and the TAN Number are automatically generated by the incorporation of one Person Company, and there is no need to make separate applications for the PAN Number and TAN Number to be obtained at the time of incorporation

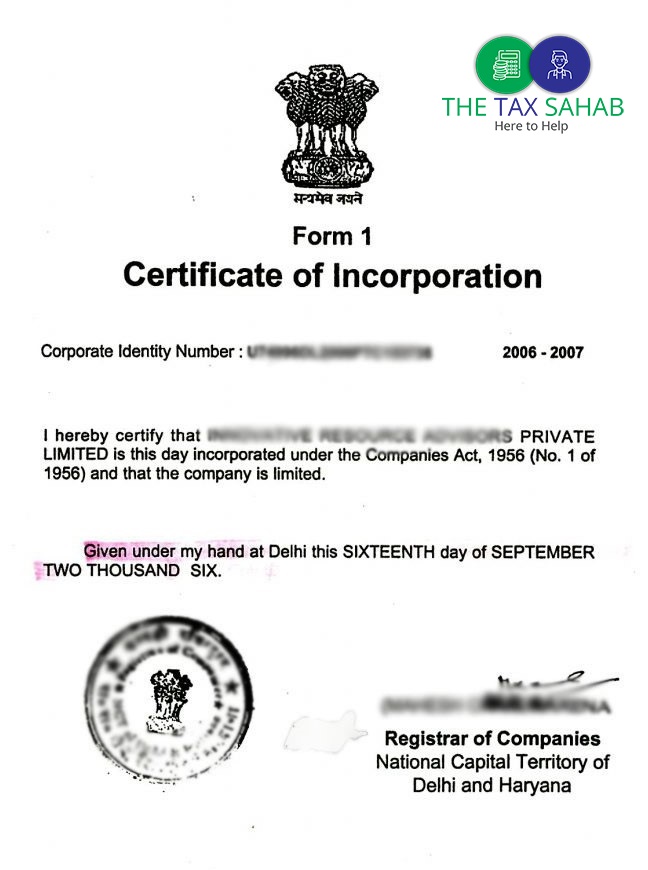

Step: 6 Company certificate of incorporation

In the event that the Registrar of Companies (ROC) has verified our application, we will be able to begin doing business as soon as the Certificate of Incorporation is issued by the ROC.

Requirements or Eligibility for setting up a One Person Company

- There should be at least one member.

- A nominee’s nomination should occur before the incorporation of the (OPC) one-person company.

- Form INC-3 should be used to obtain the consent of the candidate.

- The business name should be selected as per the guidelines of the Companies Act 2014.

- The minimum amount of capital you’ll need in order to get started is Rs. 1 lakh before you to begin your business.

- The registered address of the company must be provided as proof of its existence.

Our The Tax Sahab team can help you a great deal when it comes to registering your OPC one person company because our experts are highly qualified to do so. As a result, you can choose us as compared to other service providers on the market because our OPC registration service is the quickest you can get. Our structured service is affordable, so you can choose us without a doubt.

FAQ:

Can an OPC be converted into either a private or public company as a result of reaching any threshold limits? If so, what are these thresholds?

An OPC can be formed by anyone, but who cannot?

How to convert a private limited company from an OPC?

Conclusion:

In this article, we’ve covered the process of formation of one-person companies, and the eligibility criteria for registering an OPC. So, this type of company has become very popular in recent times due to its advantages such as limited liability protection, ease of compliance, and ease of formation. The following article provides the information you might find useful if you’re considering starting a business as an OPC and want to know more about how it works. Our goal is to provide you with useful information about an OPC so that you can decide whether it is right for you and your business.