Registering a One Person Company can be a great option for those who are looking to start their own business. It is a simple and cost-effective way to get your business up and running with minimal hassle.

In this article, we will discuss the various aspects of OPC company registration offline and how it can benefit you. We will look at the process of registering your business as an OPC, the documents required, and the one-person company registration cost.

What is OPC?

The One Person Company (OPC) is a company that is owned and operated by only one person. A single individual who wants to establish his/her own company can only do so as a sole proprietorship.

One can form a company with just one member and one director, as specified in the Companies Act, of 2013 In other words, a one-person company means that one individual, regardless of whether he/she is a resident or an NRI, can incorporate his/her business with the same features and benefits of a company and sole proprietorship.

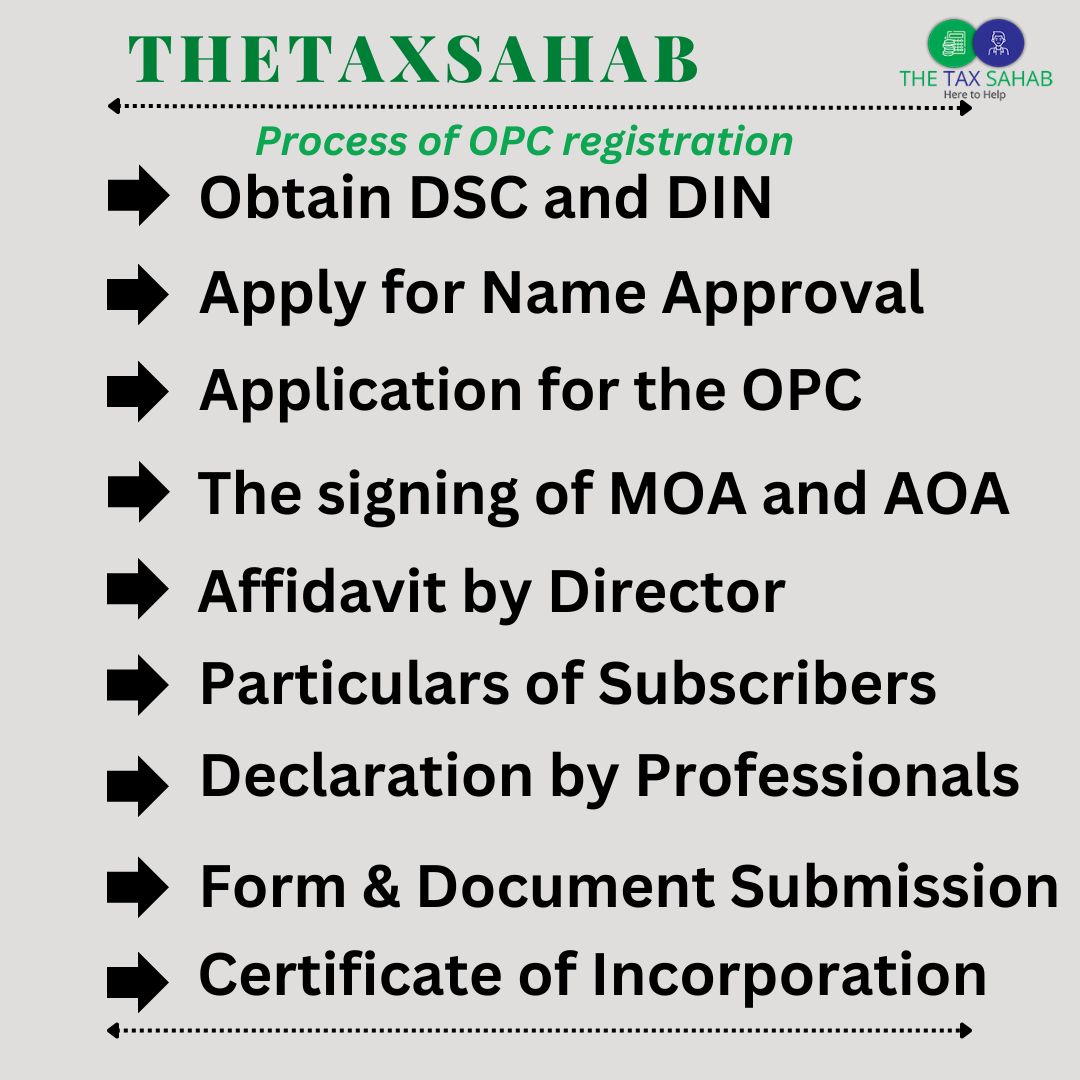

Process of OPC registration offline

The process of OPC registration is a simple yet comprehensive procedure for companies. It involves several steps. You can go through the following process of registration.

You can also contact an agency like TheTaxSahab for hassle-free registration. These agencies are experts. The following steps are included in the process of one-man company registration:

1- Obtain DSC and DIN

As the first step in this process, the DSC and DIN of the company’s director are required in order to complete the filing process.

2- Apply for Name Approval

In order to reserve the company’s name, the applicant needs to submit Form INC 1 to the Ministry of Corporate Affairs for submission. Moreover, the name must also include the suffix “OPC Pvt Ltd.” Additionally, there are two methods for reserving a name, the first of which is to submit a SPICe 32 application form, and the second of which is to use the RUN (Reserve Unique Name) Web service provided by the Ministry.

3- Application for the OPC Registration

The promoters must now apply to register with the appropriate ROC within whose jurisdiction the registered office is located and file the Registration Application in Form INC 2 with the appropriate ROC.

4- The signing of MOA and AOA

The sole member of the company will be able to carry on with the company’s activities as soon as the company’s MOA (Memorandum of Association) and AOA (Article of Association) are signed.

Additionally, the said member is required to provide information about himself in the presence of at least one witness, including his name, occupation, address, and position. The witness is also required to provide his/her basic information.

5- Affidavit by Director and Subscriber

It is now mandatory that a sole member, who is a subscriber to both MOA and AOA, must submit an affidavit in the form INC 9, which must be duly signed by the sole member, together with the MOA and AOA membership cards.

6- Particulars of Subscribers

During incorporation, the applicant will need to provide the ROC (Registrar of Companies) with the details of the subscription.

7- Declaration by Professionals

It is then necessary to fill out Form INC 8; this form should be filled in either by a CA/ Advocate/ Cost accountant/ or CS in practice at the time of filing the declaration.

8- Submission of the Forms and Documents

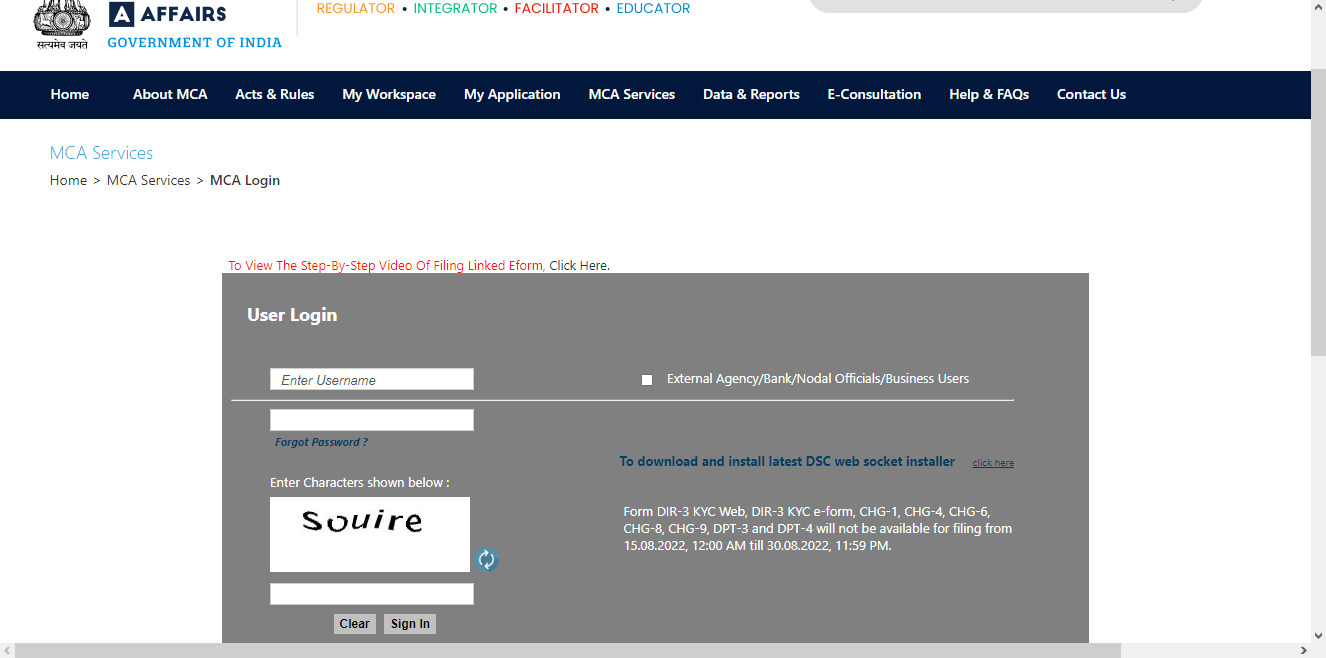

As part of this step, applicants must enclose a copy of the SPICe Form, SPICe MOA, and SPICe AOA, along with the Director’s DSC. A copy of the same document also needs to be uploaded to the official MCA website for approval.

Once the necessary documents are uploaded, Forms 49 A and 49 B will be generated automatically. They will be used to generate the TAN and PAN later in the process. Furthermore, the said MCA forms and the Digital Signature of the proposed Director have to be affixed to the MCA portal before the forms can be uploaded to it.

9- Issuance of the Certificate of Incorporation

After the incorporation process has been completed, the ROC will issue the COI (Certificate of Incorporation), allowing the business to start operations immediately following the completion of the process.

Document required for OPC registration

The documents required to register a one-person company are as follows:

- PAN card or Passport

- Photo

- Specimen signature

- No objection certificate

- Rental agreement

- Address proof of directors

Identity proof of directors For NRIs and foreign nationals, a passport

- Voter ID Card

- Driving License

- Gas or electricity bills

- Bank account statements, and phone bills for mobile or landlines

- A sample signature.

Eligibility or criteria for OPC registration

An OPC may only be formed and run by a natural person who is an Indian citizen and a resident of India. A person who has been residing in India for a time period of at least one hundred eighty-two days in the previous financial year is eligible. Some criteria of one person company registration process are as follows:

- There must be at least one member to register OPC.

- The company must be incorporated by appointing a nominee as part of the incorporation process.

- There should be a Form INC-3 to be filled out by the nominee to obtain his or her consent.

- It is required that the name of the OPC be selected in accordance with the Companies (Incorporation Rules) 2014 regulations.

- A minimum of one lakh rupees is required as the authorized capital.

- The DSC of the proposed director should be needed.

- It is mandatory for the OPC to provide proof of its registered office.

FAQ

Is it possible to have two directors in a one-person company?

What are the liabilities that a one-person company has?

What is the turnover limit for OPC?

What are the fees or cost of OPC registration India?

Conclusion:

In this article, we have discussed the various aspects of OPC company registration process offline, the documents required, and the costs associated with OPC registration.

And if you are considering starting your own OPC Company and would like to learn more about how it works, and the registration process, you may find this article to be helpful.

Providing you with useful information about an OPC will help you determine if it is right for you and your business so that you can make an informed decision.